Introducing our enhanced tax refund advance loan

$7,000 tax refund advance loan available through Mar. 17

The refund advance that helps you attract and retain clients

As tax professionals prepare for the upcoming tax season, Santa Barbara Tax Products Group (sbtpg) is announcing two big enhancements to our 2023 Fast Cash Advance program.

Larger advance amount to support larger refunds

Last tax season our clients enjoyed the highest advance approval rates and highest refund advance amounts in sbtpg history. With so many large federal tax refunds, we have increased the refund advance from $6,000 to $7,000 to put more money in your clients' hands before their refund is ready.1

Extended deadline

Fast Cash Advance has been available January 2 through February 28, but in 2023 we are extending availability through March 17, giving our tax professional partners more time to service clients with a tax time refund advance.2 Opt-in now and select the Pre-ACK advance so you can start offering Fast Cash Advance as early as January 2nd.

Up to $7,000

$1,000 more available in 2023

Offer clients a larger refund advance at tax time.

Available thru Mar. 17

Extended for 2+ weeks in 2023

Give clients more time to request an advance.

Marketing materials shipping in November

Tax professionals enrolled in our Standard Refund Transfer program receive free digital and print marketing materials. Enroll early to make sure you receive materials while supplies last.

Tax professionals that processed at least 40 Refund Transfers last tax season also receive window posters.3

Feel free to promote Fast Cash Advance

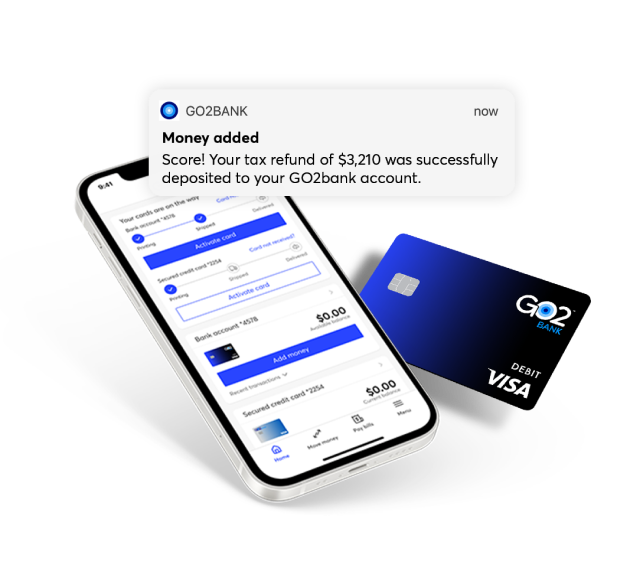

There's no ERO fee* when clients receive an IRS acknowledged advance on a GO2bank™ Visa® Debit Card.4,5

* After $39.95 incentive.

Enroll now and opt-in

Enroll now in our Standard Refund Transfer program and opt-in to Fast Cash Advance and offer the industry's leading taxpayer refund advance program.

1 Fast Cash Advance is an optional tax-refund related loan provided by First Century Bank, N.A., member FDIC (it is not the actual tax refund) and is available at participating locations. The amount of the loan and applicable interest will be deducted from tax refunds and reduce the amount that is paid directly to the taxpayer from the refund. Fees for other optional products or product features may apply and will be disclosed at the time of application. Tax returns may be filed electronically without applying for this loan. Loans are offered in amounts from $500-$7,000 and are offered both pre-IRS acknowledgment of the tax return and post-IRS acknowledgment of the tax return. All loans have an Annual Percentage Rate (APR) of 35.99%. For example, for a loan of $2,000 with a repayment period of 30 days, the total amount payable in a single payment is $2,059.16 including principal and interest. Not all consumers will qualify for a loan or for the maximum loan amount. Offer and terms subject to change at any time without prior notice.

2 Pre-ACK Fast Cash Advance available Jan. 2. In-season Fast Cash Advance available first day of filing.

3 Available to tax professionals enrolled in our Standard Refund Transfer program that processed 40+ Refund Transfers in the previous tax season. Materials available while supplies last.

4 Based on cost for post-acknowledgment refund advance. Incentive paid as long as IRS tax refund is deposited to the GO2bank Visa® Debit Card. IRS tax refund deposit must be received by 5/31/23. $39.95 incentive paid by 6/30/23 for taxpayers with Fast Cash Advance and IRS-funded Refund Transfer deposited to a GO2bank Visa® Debit Card. If enrolled through a service bureau, please check with bureau associate for details on incentive payment. Must be enrolled in the standard Refund Transfer program to qualify for standard pricing; all discount programs offered through SBTPG are subject to other pricing.

5 GO2bank cards are issued by GO2bank, Member FDIC, pursuant to a license from Visa U.S.A., Inc. Visa is a registered trademark of Visa International Service Association. GO2bank also operates under the following registered trade names: Green Dot Bank, GoBank and Bonneville Bank. All of these registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage up to the allowable limits.