Need new ideas for growing your tax practice?

Sign up for a free personalized marketing playbook

More tax products to grow your tax practice

See what's available when you make the upgrade to Santa Barbara Tax Products Group

Give clients early access to their refund!1 Your no-cost tool to satisfy more clients.

Attract clients with a refund advance up to $7,000 Jan. 2 thru Mar. 15.2

Get paid in days instead of weeks with a fee advance. Have cash for season startup expenses.3

Ready to use marketing templates and business management tools you can access anywhere.4

Service more clients by giving them the option to pay with their refund at no cost to you.5

Use Auto Collect and spend more time preparing returns and less time collecting your tax prep fees.6

Offer tax debt resolution & IRS representation services and expand the services you offer.7

Get tax software today without paying up-front with a $0 no-cost loan- there's no catch.8

The all-in-one cybersecurity solution with what you need to comply with IRS & FTC regulations.9

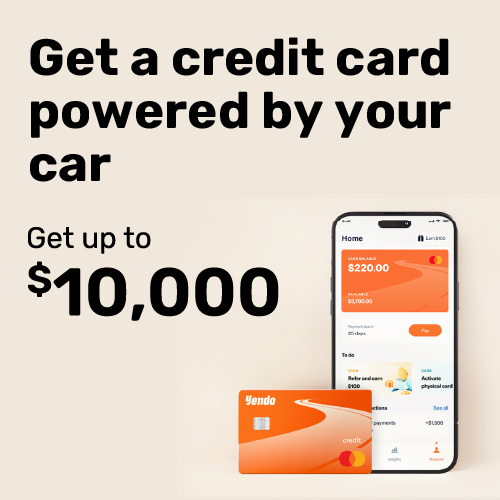

Get a credit card secured by the value of your car - not your credit score. Up to $10,000 available today.10

Give clients more payment options with credit and debit card processing.11

Help clients manage their money, plus you can earn up to $5 or $39.95 for every card you process.12

Attract clients with free digital and print marketing materials in English and Spanish.13

Download FREE video content in English and Spanish for social media promotion.

Make the upgrade today

1 Fast Forward by sbtpg is provided by Green Dot Bank. Terms and fees apply. To be eligible for Fast Forward, the taxpayer must have a Refund Transfer for a federal tax refund that is no more than $10,000 and have selected direct deposit. Availability may vary based on the taxpayer's bank participating in Real-Time Payments, IRS pre-notification of pending refund deposit, and availability of funds. $25.00 fee is not charged if the taxpayer is ineligible. If a new Green Dot card is selected in the tax office, the taxpayer will receive the federal refund up to five days early without being charged the $25.00 fee. Check with transmitter for availability.

2 Fast Cash Advance is an optional tax-refund related loan provided by First Century Bank, N.A., member FDIC (it is not the actual tax refund) and is available at participating locations. The amount of the loan and applicable interest will be deducted from tax refunds and reduce the amount that is paid directly to the taxpayer from the refund. Fees for other optional products or product features may apply and will be disclosed at the time of application. Tax returns may be filed electronically without applying for this loan. Loans are offered in amounts from $500-$7,000 and are offered both pre-IRS acknowledgment of the tax return and post-IRS acknowledgment of the tax return. All loans have an Annual Percentage Rate (APR) of 35.99%. For example, for a loan of $2,000 with a repayment period of 30 days, the total amount payable in a single payment is $2,059.16 including principal and interest. Not all consumers will qualify for a loan or for the maximum loan amount. Offer and terms subject to change at any time without prior notice.

3 Must opt-in by January 13 to qualify. Advances subject to approval. Must be enrolled in standard Refund Transfer program to qualify. All discount programs offered through Santa Barbara Tax Products Group are excluded from this program. Advances provided by Green Dot Bank, Member FDIC. Check with transmitter for availability.

4 Separate fees apply for the Marketing Pro service. Santa Barbara Tax Products Group and Green Dot Corporation cannot and do not guarantee your ability to obtain specific results in connection with our products and services.

5 Refund Transfers are deposit products using Green Dot Bank, Member FDIC, that enable certain deductions from the account to be processed. Refund Transfers are not loans. Tax refund and e-filing are required in order to receive Refund Transfer. Fees apply. Terms and conditions are subject to change without notice. Ask your preparer about other IRS e-file options, some of which are provided at no additional cost.

6 AutoCollect is an optional service provided by Santa Barbara Tax Products Group, LLC. Fees apply to the ERO only with respect to successful collections. Santa Barbara Tax Products Group is facilitating collections that are being made directly through EROs.

7 Tax debt resolution services provided by Community Tax, LLC which is not an affiliate of Santa Barbara Tax Products Group or Green Dot Corporation. Taxpayer pays a separate fee for this service.

8 Advance is subject to approval. Must enroll in Standard Refund Transfer program to qualify; all discount programs offered through Santa Barbara Tax Products Group are excluded from this program. Software Purchase Assistance advances provided by Green Dot Bank, Member FDIC. Check with transmitter for availability.

9 Cybersecurity services provided through a partnership with Watch Cloud Cyber Security which is not an affiliate of Santa Barbara Tax Products Group or Green Dot Corporation. Tax professional pays a separate fee for this service.

10 Annual fee is $40. Annual Percentage Rate is a fixed 29.88% for purchases. Cash advances accrue interest at 29.88% APR and have a 3% fee. Foreign transactions incur a 3% fee. Balance transfers incur a 5% fee.

Yendo’s products and services are provided by Yendo, Inc., which is not an affiliate of Santa Barbara Tax Products Group or Green Dot Corporation. Taxpayer pays separate fees associated with this product.

11 Online payments provided by AffiniPay, LLC, which is not an affiliate of Santa Barbara Tax Products Group. Separate fees for this service apply. CPACharge is a registered agent of Wells Fargo Bank, N.A., Concord, CA and Citizens Bank, N.A.

12 $5 incentive or $39.95 incentive paid as long as IRS tax refund is deposited to the Green Dot Prepaid Visa® Card. IRS tax refund deposit must be received by 5/31/25. $5 incentive paid by 6/30/25 for taxpayers with IRS-funded Refund Transfer deposited to a Green Dot Prepaid Visa® Card. $39.95 incentive paid by 6/30/25 for taxpayers with Fast Cash Advance and IRS-funded Refund Transfer deposited to a Green Dot Prepaid Visa® Card. Tax professionals using discount programs do not qualify. If enrolled through a service bureau, please check with bureau associate for details on incentive payment. Must be enrolled in the standard Refund Transfer program to qualify for standard pricing; all discount programs offered through Santa Barbara Tax Products Group are subject to other pricing. A 1099 may be issued for incentive payments exceeding $600. Green Dot cards available while supplies last.

Green Dot® card is issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A., Inc. Visa is a registered trademark of Visa International Service Association. Green Dot Bank also operates under the following registered trade names: GO2bank, GoBank and Bonneville Bank. All of these registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage up to the allowable limits.

13 Available to tax professionals enrolled in our standard Refund Transfer program. Materials available while supplies last. Additional cost for premium marketing materials.