Give clients early access to their refund1

NEW! Cashier's check disbursement

Get paid when your clients Fast Forward their federal tax refund2

No cost to you

Process 10+ funded Fast Forwards & earn $5 per client

$25 cost paid from your client's refund

Good credit not required

Client chooses how to receive refund

Your no-cost tool to satisfy more clients

Your clients can request Fast Forward by sbtpg when they select the Refund Transfer. When the IRS funds their federal refund, they can get their refund up to 5 days early.

Qualifying is simple

- No credit? No problem! - good credit is not required

- Help clients - available to clients expecting a federal tax refund

- Works with a network of banks - banked clients can use existing bank account

- Widely available - available to clients with federal tax refunds up to $10,000

- Clients choose - available by check, direct deposit or Green Dot® Prepaid Visa® Card2

How it works

Offer Fast Forward

When your client selects the Refund Transfer offer Fast Forward if they want their refund early

Transmit the return

When your client requests Fast Forward, select it in your tax preparation software, secure your client's approval, and transmit the tax return

Refund arrives early

When the IRS releases their refund, your client will be notified once their refund arrives early*

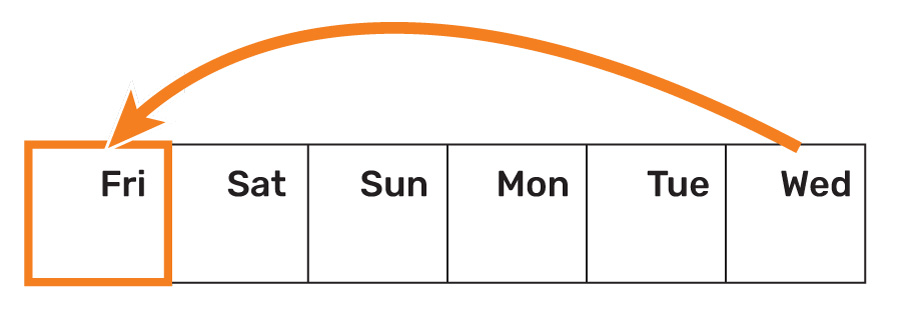

Example

If the IRS notifies us Friday of a federal tax refund effective Wednesday, with Fast Forward the refund is available immediately. With the traditional ACH direct deposit settlement process, the refund would be available on Wednesday.

In this example, the federal tax refund is released 5 days earlier than the IRS effective date.

* Message and data rates may apply

Enroll now to offer Fast Forward

1 Fast Forward by sbtpg is provided by Green Dot Bank. Fast Forward enables taxpayer to receive federal tax refund up to five (5) days early for an additional fee of $25.00. Terms apply. To be eligible, taxpayer must have a Refund Transfer for a federal tax refund that is no more than $10,000. Availability of Fast Forward is subject to the taxpayer's bank participating in Real-Time Payments, IRS pre-notification of pending refund deposit, and availability of funds. $25.00 fee is not charged if the taxpayer is ineligible. If a new Green Dot card is selected in the tax office, the taxpayer will receive the federal refund up to five days early without being charged the $25.00 fee. If a cashier’s check is selected as the disbursement method, the exact timing the taxpayer will receive their federal refund is dependent upon when the tax preparer prints the check. Check with transmitter for availability.

2 Green Dot® card is issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A., Inc. Visa is a registered trademark of Visa International Service Association. Green Dot Bank also operates under the following registered trade names: GO2bank, GoBank and Bonneville Bank. All of these registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage up to the allowable limits.

3 Process 10+ funded Fast Forwards and receive a $5 incentive for each funded Fast Forward issued by check or deposited to taxpayers' bank account (excluding any deposits to a Green Dot card) by 5/31/26. Incentives paid by 7/15/26.