How to enroll with sbtpg

Instructions for ProSeries Customers

ProSeries Professional

Enrollment begins November 15

ProSeries Basic

Enrollment begins in early December

After installing your ProSeries software for the upcoming tax season, an in-product registration enrollment must be completed and submitted to sbtpg.

Important! This registration enrollment must be submitted from each standalone computer where ProSeries is used to transmit returns that request Pay-by-Refund products (Refund Transfer or Quick Collect). This enrollment is necessary to register each ProSeries software installation to participate in Pay-by-Refund or Quick Collect through sbtpg.

Step 1

Within your current tax year ProSeries software, launch the ProSeries Options Setup Wizard.

- Click the Help menu at the top of the ProSeries screen.

- Select Options Setup Wizard.

Step 2

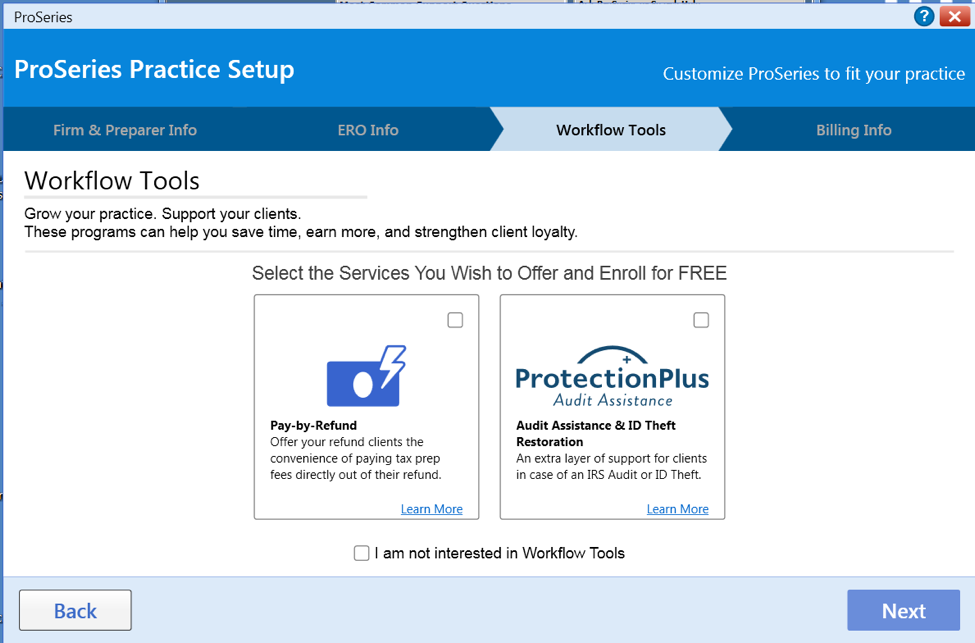

Proceed through the Options Setup Wizard screens until presented with the Workflow Tools screen. Select Pay-by-Refund and click next to continue.

Step 3

Select sbtpg to participate in our Standard Refund Transfer program.

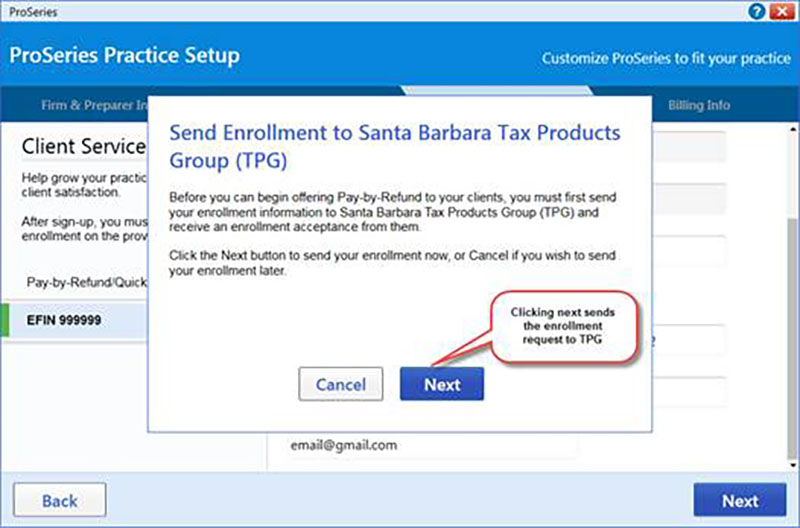

Click the EFIN on the left side of the screen to verify the accuracy of the Firm and Owner information before submitting your enrollment request. Important! A physical street address is required.

If the Firm and Owner information is correct, click Next to continue.

Step 4

At the Send Enrollment to sbtpg window, click Next to transmit your enrollment information to us.

Step 5

After the Enrollment information is transmitted, a confirmation window will inform you if the submission was successful. We will notify you upon approval. You can also logon to our website to check your enrollment status.

Once approved, you'll need to complete the sbtpg compliance training and verify your information.