Getting setup is fast and easy

It's easier to go from enrollment to getting paid

Upgraded technology

Get all the benefits of a modern banking partner*

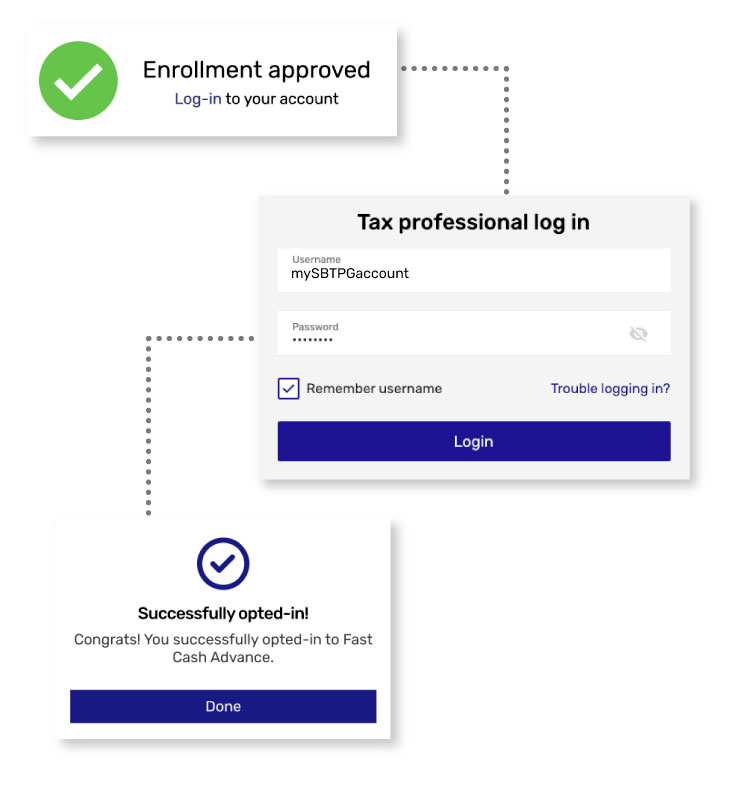

Easy access

Lightning fast log-in experience

Our tax pro website has been completely upgraded with a fast and easy-to-use log-in experience.

Up to 7X Faster

Refund processing

Performance upgrades helped us process refunds up to 7X faster in 2023. We're making sure our clients print checks faster on big funding days.

Major upgrades

Improvements made organization-wide

Technology upgrades across our organization have improved processing speed, reliability, and increased client satisfaction. Expect even more improvements in 2024.

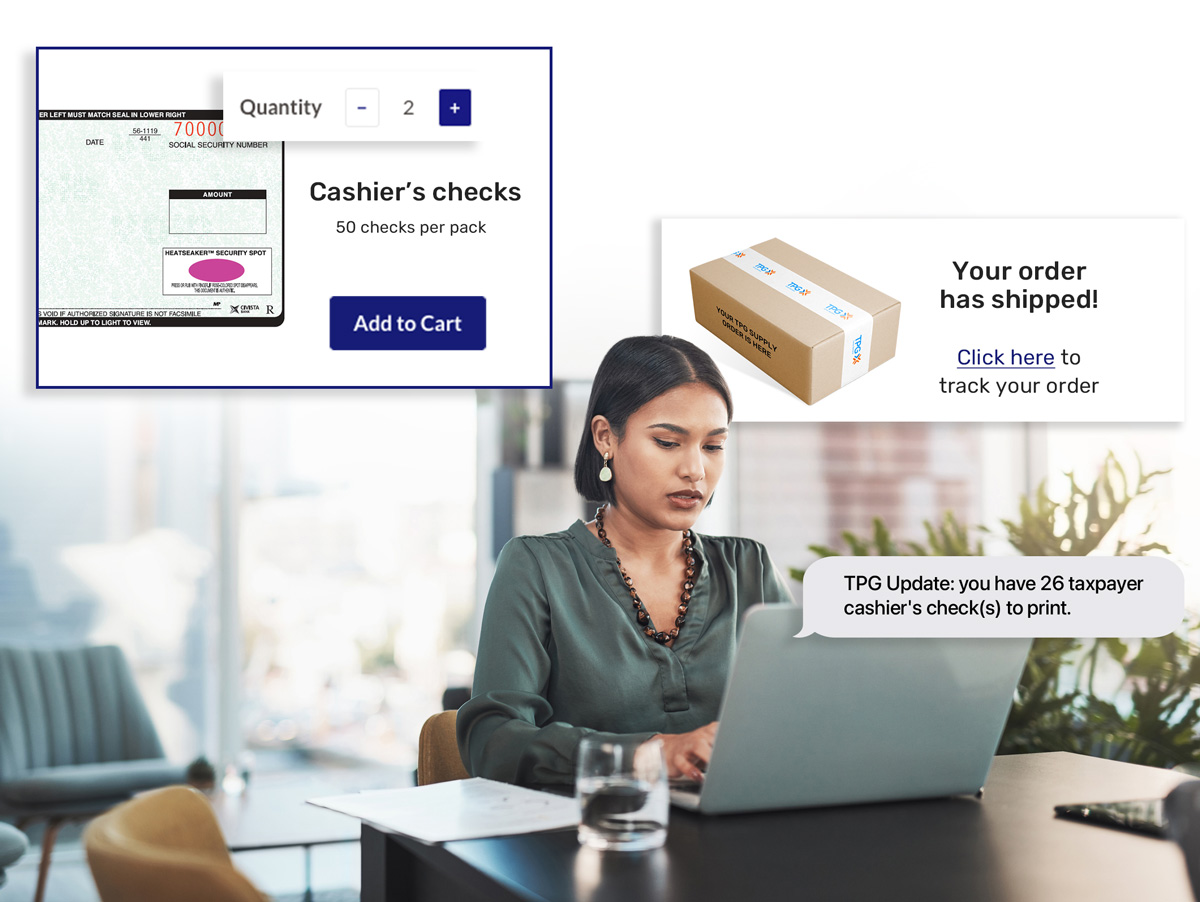

Got our ship together

Flawless shipping process

Free supply orders start shipping in November, and in 2023 we shipped orders faster than ever. Free digital ads are delivered straight to your inbox.1

* SBTPG is a service provider, not a bank. Banking services provided by Green Dot Bank, Member FDIC.

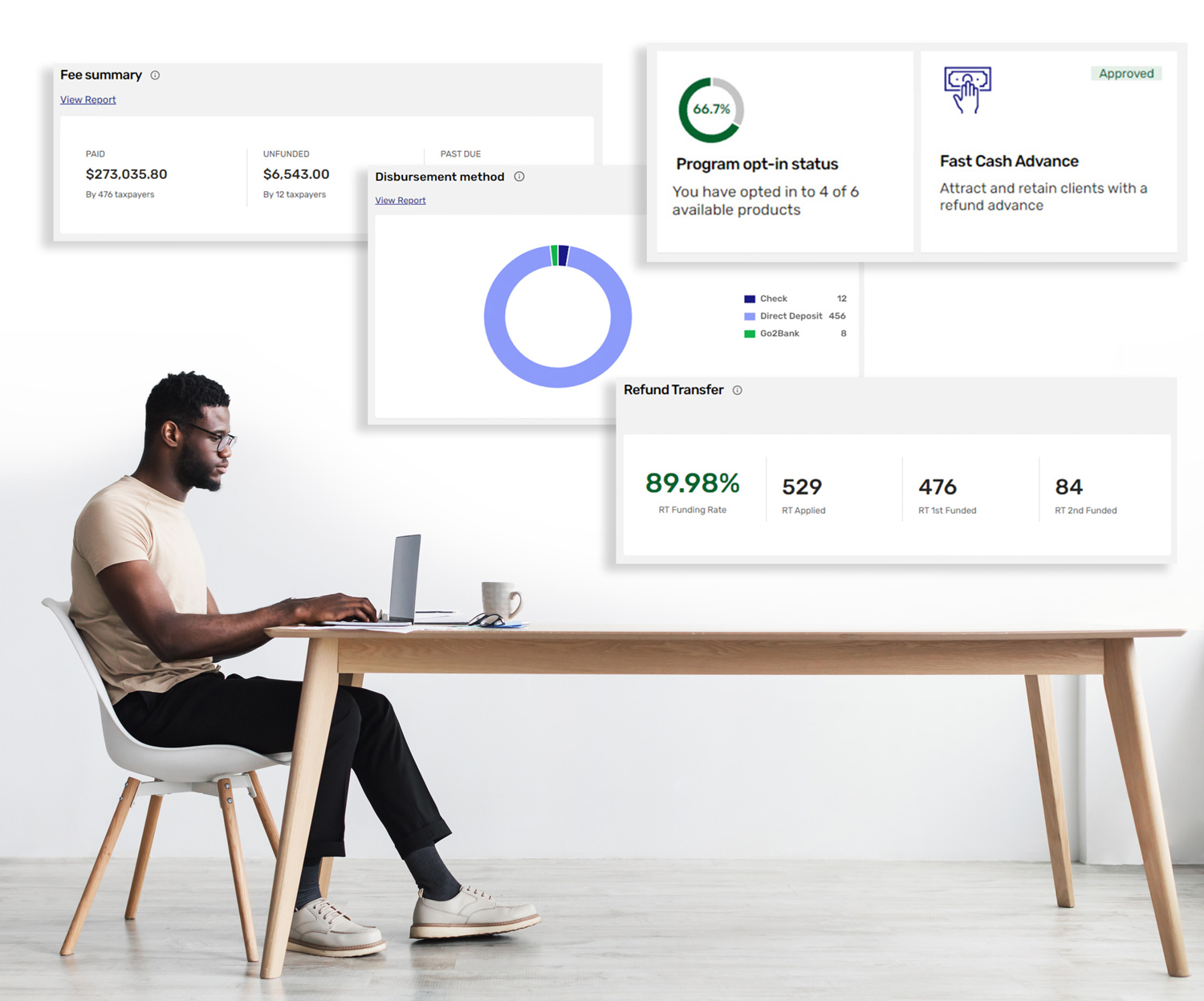

Manage your business at a glance

Track and manage your tax practice in real time

- Summary view for tax pros with multiple offices

- See recent payments, funded clients & more

- Drill-in to related reports from the dashboard

Customer support has never been better

We staffed up, added service channels and support resources

Under 3 min.

Average call hold time during peak tax season

40%

Reduction on incoming calls

20+

New help center articles to answer questions 24/7

Products that give you an edge

More for you and your clients

$7,000 Fast Cash Advance

Available through mid-March

Attract clients with an industry-leading refund advance program, with over 8 out of 10 loans approved.2

Nearly 2X more cash flow

Cash flow help to fund your success

Get an advance on your tax preparation fees so you get paid in days, not weeks. Up to $338,800 available to qualified tax pros.3

Tax Debt Resolution

Expand your services without adding staff

Serve balance due clients with tax debt resolution and IRS representation through our referral program and earn a share of the revenue.4

Auto Collect

Collect payment from past-due clients

For the handful of clients that pay-by-refund and don't receive funding, use Auto Collect and collect from past due clients. You only pay for fees that are successfully collected.5

Marketing Pro

Promote and manage your business

Subscribers get a web presence, email and SMS marketing, online appointment scheduling, secure file sharing and more.6 e-Signature and other features now available through our new app market.7

Buy tax software now

No cost tax preparation software loan

Apply for a no cost loan to purchase tax preparation software with Software Purchase Assistance (SPA). The loan is repaid from the tax preparation fees withheld from IRS or State funded Refund Transfers.8

Raising the bar

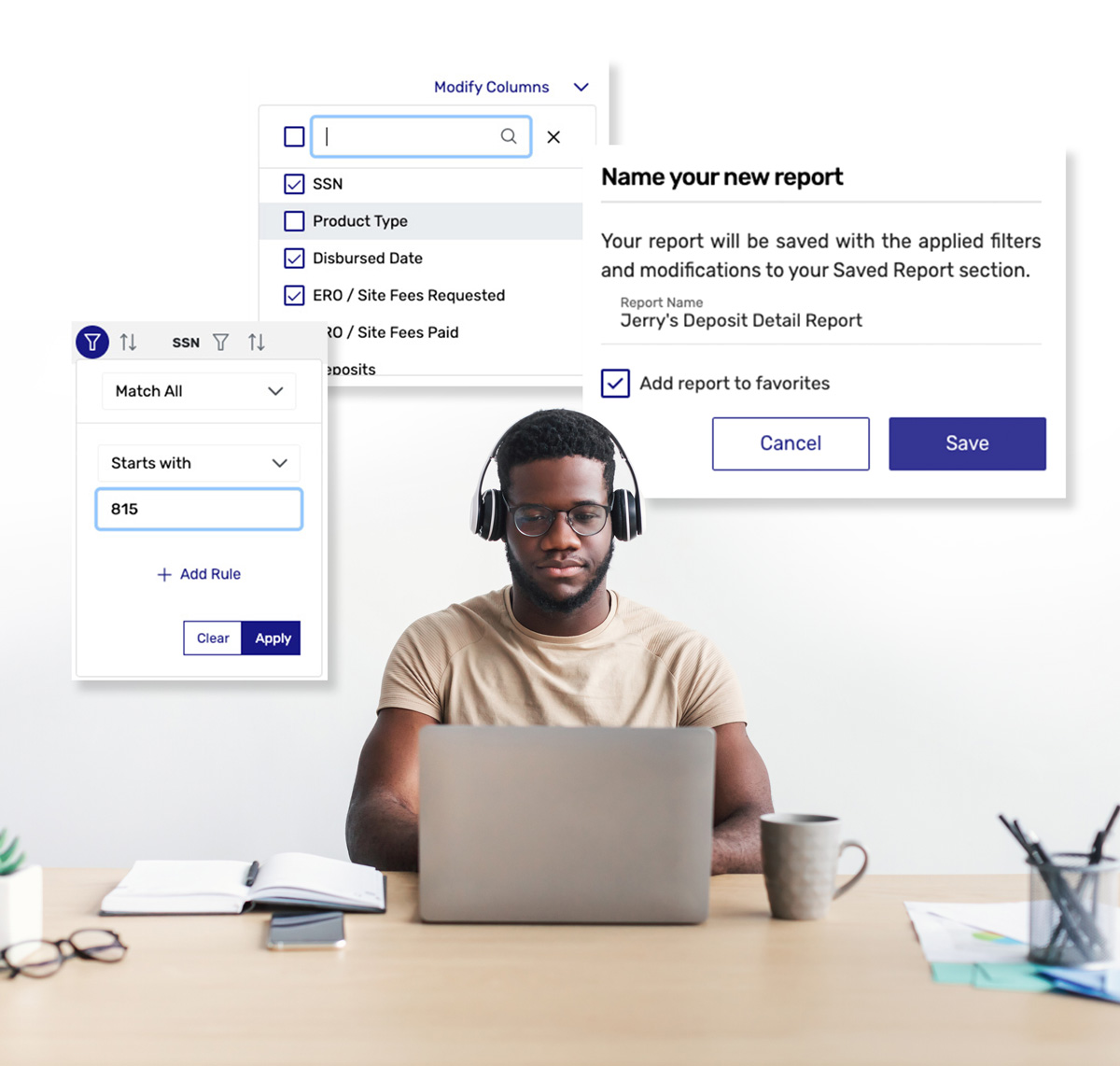

We have completely updated our report engine, giving you best-in-class reports

Find what you need in less time

Personalize reports help you manage your money

- Filter, sort, search and more

- Add and remove columns to see what's important

- Customize and save your favorite reports

- Export to csv or pdf

Experience the difference

Enroll now and get what you need for 2025

1 Marketing materials are available to tax professionals enrolled in our standard Refund Transfer program.

2 Fast Cash Advance is an optional tax-refund related loan provided by First Century Bank, N.A., member FDIC (it is not the actual tax refund) and is available at participating locations. The amount of the loan and applicable interest will be deducted from tax refunds and reduce the amount that is paid directly to the taxpayer from the refund. Fees for other optional products or product features may apply and will be disclosed at the time of application. Tax returns may be filed electronically without applying for this loan. Loans are offered in amounts from $500-$7,000 and are offered both pre-IRS acknowledgment of the tax return and post-IRS acknowledgment of the tax return. All loans have an Annual Percentage Rate (APR) of 35.99%. For example, for a loan of $2,000 with a repayment period of 30 days, the total amount payable in a single payment is $2,059.16 including principal and interest. Not all consumers will qualify for a loan or for the maximum loan amount. Offer and terms subject to change at any time without prior notice.

3 Must opt-in by February 19 to qualify. Advances subject to approval. Must be enrolled in standard Refund Transfer program to qualify. All discount programs offered through SBTPG are excluded from this program. Advances provided by Green Dot Bank, Member FDIC. Check with transmitter for availability.

4 Tax debt resolution services provided by Community Tax, LLC which is not an affiliate of Santa Barbara Tax Products Group or Green Dot Corporation. Taxpayer pays a separate fee for this service.

Referral fee paid monthly to qualified tax professionals by Santa Barbara Tax Products Group. Referral fee is 10% of the service fee paid by the taxpayer to Community Tax for tax resolution services. SBTPG may be paid for your referral. Neither Santa Barbara Tax Products Group or Green Dot Corporation, nor any of their respective affiliates are responsible for the products or services provided by Community Tax, LLC. Fees, terms and conditions apply.

5 Auto Collect is an optional service provided by Santa Barbara Tax Products Group, LLC. Fees apply to the ERO only with respect to successful collections. SBTPG is facilitating collections that are being made directly through EROs.

6 Separate fees apply for the Marketing Pro service.

7 Separate fees may apply.

8 Check with transmitter for availability. To qualify you must have 20 or more taxpayers that applied for the Refund Transfer with 85% or more of those Refund Transfers receiving IRS and/or State funding.

Please check with your software provider for program and product availability. Refund Transfers are deposit products using Green Dot Bank, Member FDIC that enable certain deductions from the account to be processed. Refund Transfers are not loans. Tax refund and e-filing are required in order to receive Refund Transfer. Fees apply. Terms and conditions are subject to change without notice. Ask your preparer about other IRS e-file options, some of which are provided at no additional cost.