Give clients a pay-by-refund option with the Refund Transfer

Collect tax prep fees from your client's tax refund1

The easy way to get paid

Available first day of filing

$44.95 fee paid by taxpayer

Your fees are taken out of your client's refund

Clients choose how to receive their refund

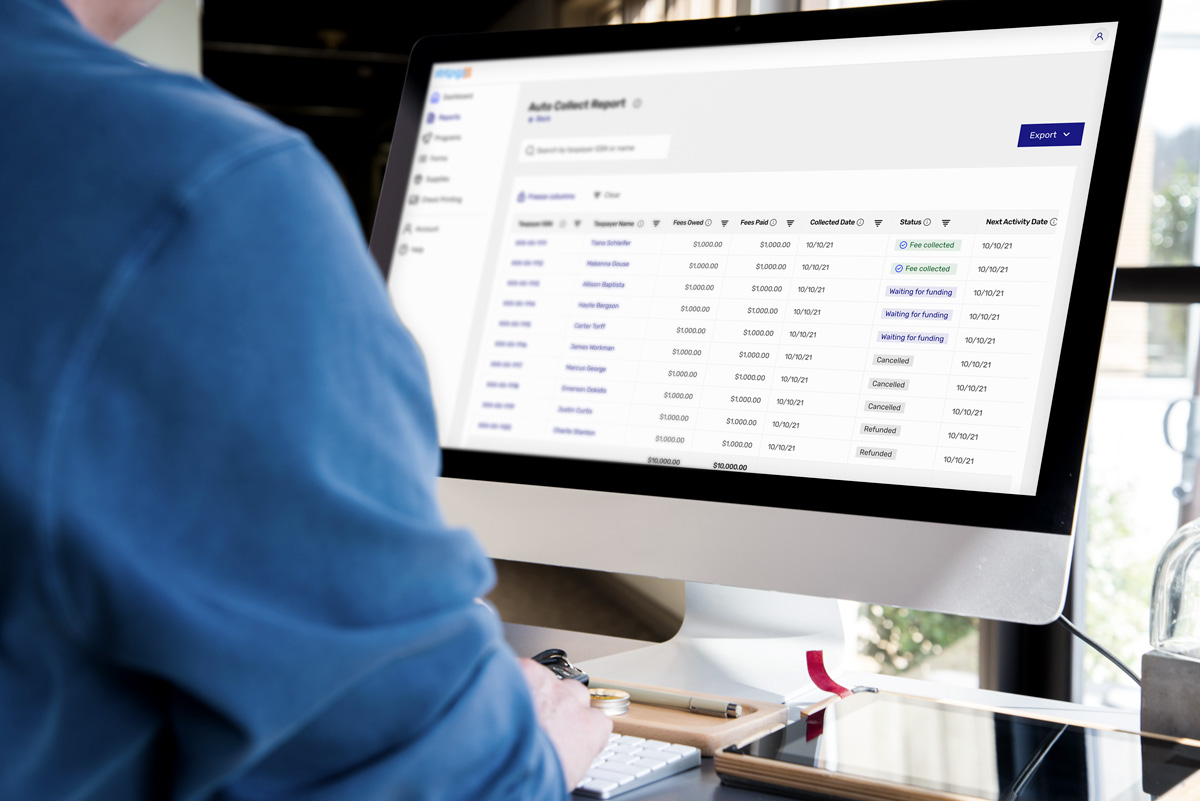

Upgrade the Refund Transfer with Auto Collect

Collect unfunded tax preparation fees from past-due clients6

Marketing that works

Free Marketing

Enroll in our standard Refund Transfer program and we'll ship a free marketing kit to you.7

Premium Materials

Get attention with high-profile materials like flags, banners and oversized posters.7

Free Direct Mail

Personalized postcards addressed to your return clients help you retain more clients.8

Digital advertising

Access dozens of videos and free digital ads you can use for social media, your website, email, and more.

Enroll today

1 Refund Transfer is a deposit product offered by Green Dot Bank, Member FDIC, that enables authorized amounts to be deducted from taxpayer’s refund, with the remaining balance then paid to the taxpayer. Fees apply. Refund Transfers are not loans. Tax refund and e-filing are required to receive Refund Transfer. Terms and conditions are subject to change without notice. Ask your preparer about other IRS e-file options, some of which are provided at no additional cost.

2 Green Dot® Prepaid Visa® Cards are issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A., Inc. Fees apply. Visa is a registered trademark of Visa International Service Association. Green Dot Bank also operates under the following registered trade names: GO2bank, GoBank and Bonneville Bank. All of these registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage up to the allowable limits.

3 1.9% rate valid until 12/31/25. Some Restrictions may apply. For full list of checks and fees visit www.amscot.com.

4 Rates for cashing other types of checks and money orders at PLS will vary based on the type and amount of the check and other risk factors. Visit a PLS store for complete fee information.

For NY: PLS Check Cashers of New York, Inc. is licensed by the Superintendent of Financial Services pursuant to Article 9-A of the Banking Law.

For OH: PLS Check Cashers 1397 West Mound Street, Columbus, OH 43223 License CC.700135.

For MA: Check cashing license #CC0030.

PLS is a registered service mark of PLS Financial Services, Inc. ©2025.

5 Cost is $4 or less for checks up to $1,000 and $8 or less for checks up to $7,500. Currently, check cashing at Walmart is not available in NJ and NY. The check limit at Walmart in CT is $6,000 and FL is $1,999.99 per person per day. Fees and limitations apply.

6 Auto Collect is an optional service provided by Santa Barbara Tax Products Group, LLC (SBTPG). Fees apply to the ERO only with respect to successful collections. SBTPG is facilitating collections that are being made directly through EROs.

7 Available to tax professionals enrolled in our standard Refund Transfer program. Materials available while supplies last. Additional cost for premium marketing materials.

8 Available to returning clients with 100+ applied Refund Transfers enrolled in our standard Refund Transfer program.